Coface Country Risk confirmed credit risk rating A3 for Slovakia

The gradual recovery in the eurozone is breathingnew life into economy

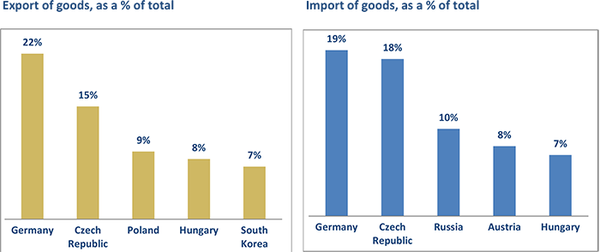

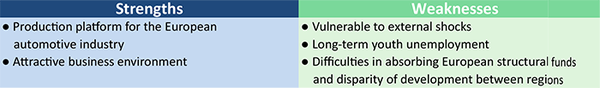

The Slovak economy slowed sharply in 2013 due to weaker eurozone demand and difficulties in the European automotive sector caused by slower demand from the major emerging countries (China,India,Brazil). Indeed, the three main carmakers that share the Slovak market (Volkswagen, PSA, Peugeot, Citroen and Kia motors) produce for foreign markets. Meanwhile, growth has been hit by sluggish consumption due to high unemployment and fiscal adjustment efforts. 2014 is likely to be marked by a loosening of these adjustments, which will boost consumption and stimulate growth. Investment and exports should benefit from the slight recovery of activity in the eurozone, which will impact positively on industry, whose production was already up by 7.5% in Q4 2013. Manufacturing grew 9.9% and metal by 23.5% following the decision ofUS Steel Kosiceto keep its production site in exchange for environmental and energy concessions. This should, moreover, enable the automotive industry, whose main steel provider it is, to boost its production and continue as one of the engines of growth in 2014. Electronic consumer goods grew by a massive 58% in Q4 2013.

The activity downturn brought inflation below the 3% threshold in 2013. The new energy law provides for price regulation from 2014, which will help stabilise energy prices and maintain moderate inflation.

Fiscal deficit adjustment will remain a priority

The fiscal deficit reached the 3% threshold in2013 inline with the government’s commitment. The introduction of progressive taxation and higher taxes explain this result. The tax rate on monthly incomes above €3,246 rose from 19% to 25%; and for companies with profits in excess of €30 million, the tax rate went up from 19% to 23%. There is a risk that the 3% target will not be reached in 2014 because measures still need to be taken to enhance VAT collection and reduce tax evasion. Moreover, tax levels in Slovakia are below the regional average, and tax relief continues to be granted to the steel industry. Although public debt is increasing, Slovakia has no difficulty in funding its needs: financing conditions remain favourable, with government 10-year bond yields at 2.6% in late 2013.

The current account surplus is growing due to automotive sector exports and weak domestic demand. However, in 2013, the sharp decline in foreign direct investments in a context of overproduction in the automotive sector, created a need for finance that the reserves were unable to cover. With the expected recovery in 2014, brought about a resumption of investments and increased exports, the accumulation of reserves should enable any shocks to be resisted. The banking sector, dominated by western European players (mainly Austrian and Italian), has high capitalisation and liquidity ratios. Private sector credit could take off again in 2014, reflecting the boom in activity.

Stable political environment; difficulties in absorbing European structural funds

Prime Minister Robert Fico and Social Democrats (Smer-SD), who returned to power in 2012, hold the majority in Parliament (83 out of 150 seats) and have a pro-European programme. They won the regional elections in November 2013. Robert Fico emerged stronger from a vote of confidence in Parliament in September 2013, and despite the Economy Minister’s resignation in November 2013 over accusations of involvement in conflicts of interest, the government is expected to remain in power until the next parliamentary elections in June 2016. The fiscal adjustment reforms are likely, therefore, to be conducted without major risk of political stalemate, especially as the opinion polls continue to show huge popular support the Smer-SD. Slovakia benefits from the EU’s structural and cohesion funds (European Social Fund and Regional Development Fund) and from the European Agricultural Fund for Rural Development (EAFRD). But the low absorption rate of the funds allocated, due to non-transparent tender procedures, weak administration and weak project management skills, could slow the reduction of regional disparities and the dynamism of the economy (jobs, infrastructure and business environment). Meanwhile, judicial procedures are rather lengthy and electricity prices remain high compared with the EU average, which could prove detrimental to investment.