Preskúmajte prieskum platobného správania podnikov vo Francúzsku v roku 2023, ktorý odhalil dlhšie a častejšie oneskorenia platieb, čo má vplyv na malé spoločnosti.

V roku 2023 ponúklo 97 % francúzskych spoločností svojim zákazníkom platobné podmienky s priemernou lehotou 48 dní.

Napriek tomu 82 % spoločností zaznamenalo za posledných 12 mesiacov oneskorenie platieb zo strany svojich klientov.Väčšina z nich uviedla, že k oneskoreným platbám dochádza častejšie a dlhšie ako v minulom roku.Zhoršenie platobných zvyklostí firiem sa odráža aj v počtoch platobnej neschopnosti, pričom od začiatku roka bol zaznamenaný nesporný nárast, ktorý dokonca prekročil úrovne spred zavedenia programu Kovid.

Platobné podmienky1: zaužívaná prax

Predlžovanie platobných podmienok je vo Francúzsku zaužívanou praxou: 97 % spoločností ich ponúka svojim klientom bez ohľadu na odvetvie a veľkosť spoločnosti. Priemerná lehota je 48 dní, čo je výrazne viac ako lehoty ponúkané v Nemecku (32 dní) alebo dokonca v Poľsku (46 dní), ale stále oveľa menej ako lehoty ponúkané v Číne (81 dní) a zvyšku Ázie (66 dní).

Dôkazom rozšírenosti tejto praxe vo Francúzsku je skutočnosť, že hoci veľmi malé podniky sú relatívne menej náchylné poskytovať platobné podmienky, 95 % z nich ich v skutočnosti poskytuje. Platobné podmienky sú však kratšie. Napríklad 35 % z nich ponúka platobné podmienky kratšie ako jeden mesiac v porovnaní s približne 10 % v prípade iných veľkostí podnikov.

Oneskorenie platieb: situácia sa stáva napätou, najviac postihnuté sú VSE a MSP

82 % spoločností zaznamenalo v roku 2023 oneskorenie platieb. Je to častejšie ako v Poľsku (61 % spoločností), Nemecku (76 %) a Ázii (57 %), kde sú platobné podmienky dlhšie, ale oneskorenia sú menej časté.

Dôležitým faktorom ovplyvňujúcim oneskorenie platieb je veľkosť spoločnosti. 70 % VSE a MSP deklarovalo, že oneskorenia platieb sa zvýšili, v porovnaní s „iba“ 53 % stredne veľkých spoločností a veľkých spoločností. Okrem toho väčšina VSE a MSP uviedla častejšie oneskorenia platieb ako v roku 2022. 54 % VSE zaznamenalo meškanie platieb dlhšie ako jeden mesiac a takmer 20 % zašlo tak ďaleko, že uviedlo meškanie platieb dlhšie ako dva mesiace. Priemerné oneskorenie platieb ako také predstavuje v prípade VSE 42 dní v porovnaní s 38 dňami v prípade MSP a „len“ 26 dňami v prípade väčších spoločností. Výsledky sú ešte znepokojujúcejšie, keďže polovica VSE uviedla, že oneskorené platby majú „veľmi dôležitý“ alebo „kritický“ vplyv na ich hotovostnú situáciu.

Medzi uvádzanými dôvodmi 27 % respondentov uviedlo finančné ťažkosti svojich klientov ako dôvod oneskorenia platieb, približne 41 % z nich má podozrenie, že klienti zámerne zdržiavajú platby na účely riadenia peňažných tokov.

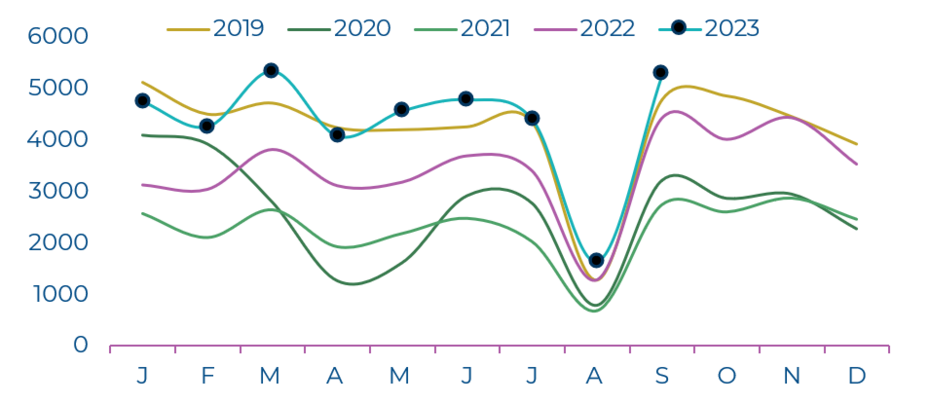

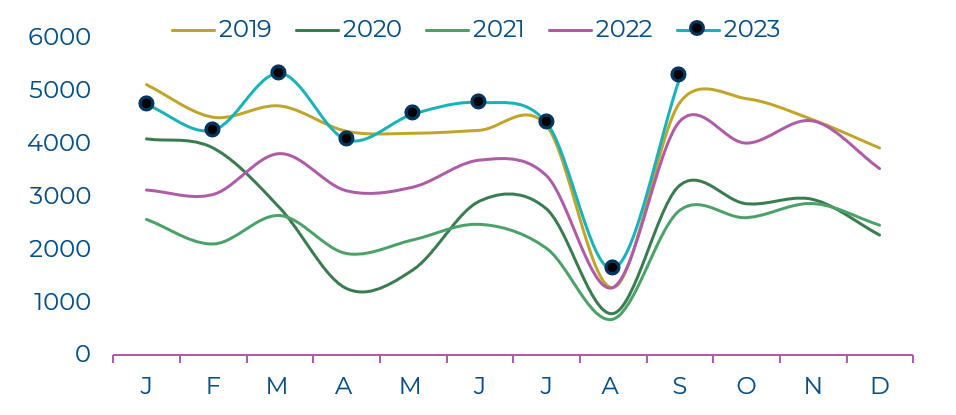

Počet insolvencií vo Francúzsku rastie

Po tom, ako sa počet podnikových insolvencií udržal na mimoriadne nízkej úrovni až do polovice roka 2022, sa koncom minulého roka vrátil na úroveň spred zavedenia systému Kovid. Za prvých 9 mesiacov roka bolo zaznamenaných39 098 insolvencií, čo je o 34 % viac ako v roku 2022 a o 4,5 % viac ako v roku 2019.

Táto dynamika sa týka všetkých odvetví. K insolvenciám prispeli subjekty, ktoré dosahujú príjmy nižšie ako 250 000 EUR (+8 % v porovnaní s obdobím január-september 2019), a subjekty, ktoré dosahujú príjmy vyššie ako 10 miliónov EUR, tiež zaznamenali výrazne viac insolvencií ako v predkomisijnom období (+8 %).

Tento trend bude v nasledujúcich štvrťrokoch pokračovať, pričom marže a peňažné toky budú pod tlakom v dôsledku obmedzujúcich podmienok financovania, obmedzenejšieho dopytu a rastúcich nákladov.

Mesačná platobná neschopnosť podnikov

Zhoršujúci sa hospodársky výhľad a viaceré riziká

90 % opýtaných spoločností očakáva, že sa hospodárske podmienky vo Francúzsku a na celom svete zhoršia alebo v najlepšom prípade zostanú stabilné, pričom toto očakávanie zdieľajú spoločnosti všetkých veľkostí.

Napriek pretrvávajúcim obmedzeným vyhliadkam rastu Francúzska a Európskej únie v roku 2024 sú tieto dva trhy naďalej vo veľkej miere preferované vyvážajúcimi spoločnosťami (72 % v prípade Francúzska a 60 % v prípade EÚ), ktoré ich považujú za najlepšie príležitosti pre svoje podnikanie v budúcom roku.

V neistej globálnej geopolitickej situácii, ktorá podporuje nearshoring2 a friendshoring3, 12 % opýtaných spoločností uviedlo, že už presunulo aspoň časť svojej činnosti. 84 % spoločností, ktoré premiestnili alebo plánujú premiestniť časť svojej činnosti, tak plánuje urobiť vo Francúzsku.

1 Platobné podmienky - časový úsek medzi okamihom, keď si klient zakúpi výrobok alebo službu, a okamihom splatnosti platby.

2 Nearshoring - premiestnenie hospodárskej činnosti do geograficky blízkej krajiny.

3 Friendshoring - premiestnenie hospodárskej činnosti do krajiny, ktorá je geopolitickým spojencom.