Quarterly update of the Coface country risk assessments

Although worldwide growth continues to recover,its rate will not exceed 3% for the fourth year in a row. The advanced economies are doing much better: Activity in the USA rose significantly in the 2nd quarter (2.5% forecast for 2015), thanks to both consumer spending and investment, and in the Eurozone (1.5%) the gradual upturn in activity continues.

The emerging countries (forecast growth of 3.5% in 2015, 4.2% in 2016) are overshadowed by the weakness of raw material prices and the fall in exchange rates against the dollar. In a number of the larger emerging countries, activity slowed down (China, Turkey, South Africa) or went into recession (Russia and now Brazil). The recent Chinese stock market collapse and its consequences on raw material prices have only intensified these weaknesses. According to Coface, the country risk in the emerging countries will remain a major point of vigilance this year.

A number of small emerging countries, dragged down by large emerging countries

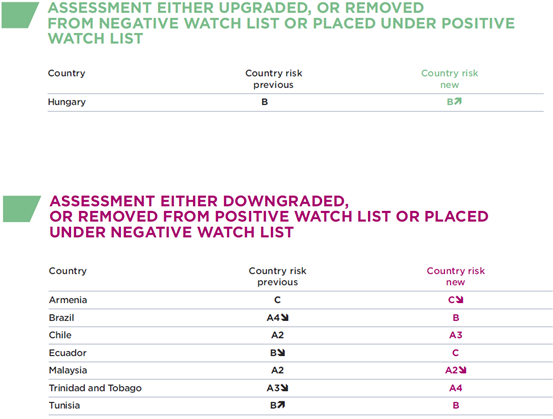

In this context of a worsening macroeconomic situation in the large emerging countries, Coface is signalling a rise in the level of risk in several smaller countries.

- The A2 assessment for Malaysia is under a negative watch. The country, dependent on external demand, is suffering as a result of the slowdown in the Chinese economy (one of its main partners) and the fall in raw material prices. The high levels of household debt and public debt are a risk.

- Armenia, assessed C, is placed under negative watch, because of its economic and financial dependence upon Russia, its political instability and a sharp deterioration in public finances.

- Tunisia has lost the positive watch of its B assessment (since March 2015), with a strong likelihood of going into recession, following the economic blow dealt by the terrorist attacks, particularly in the tourism sector. The continuing risk from terrorists and the increase in social tensions in sectors previously affected by the economic crisis have erased the initial positive effects of the political transition.

Latin America: the assessments of four countries downgraded by one notch

Latin America (forecast of a 0.2% recession in 2015) underwent a new wave of downward revisions in assessments.

- Brazil, placed under negative watch by Coface in March, has been downgraded to B. Its economy is in recession (-2.5% growth forecast for 2015), in a context of increased political instability. Household consumer spending, the main driver of growth, and investment both fell, notably given the repercussions of the Petrobras affair.

- Ecuador, also under negative watch since March, has seen its assessment downgraded to C. This country is the second hardest-hit by the fall in the price of oil (40% of budget revenues, over 50% of exports), which is having an impact on public spending and investment. The prospects for local private companies are looking worse, due to tariff disagreements with Colombia and Peru. The economy is highly dependent upon Chinese capital, from whom loans are secured through the award of mining concessions, oil revenues and future electricity production.

- Chile, whose assessment has been downgraded to A3,is suffering from the sustained fall in copper prices and the slowdown in China (the main destination for Chile's copper). Corruption scandals are destabilising the business environment.

- Having recovered from recession in 2012 and enjoying a favourable business climate, Trinidad and Tobago, now with an assessment of A4, is suffering from the negative effects of the continuing low oil prices. One other problem persists: the development of gas supplies and infrastructure.